42+ mortgage interest limitation $1.1 million

Web For 2018 through 2025 the new tax law generally allows you to treat interest on up to 750000 of home acquisition debt incurred to buy or improve your first or. Take Advantage And Lock In A Great Rate.

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

What More Could You Need.

. Ad Our Mortgage Experts Are Standing By To Help You Take Advantage of These Lower Rates Now. Apply Now With Quicken Loans. Web The statute makes it clear that married taxpayers are subject to the limit jointly.

The IRS audited their. Apply Now With Quicken Loans. Use NerdWallet Reviews To Research Lenders.

Web Section 163 h 3 provides that in the case of a married taxpayer who files a separate return the 1000000 limit on qualified residence interest and 100000 of. Web In filing their 2006 and 2007 returns the taxpayers each took advantage of the 11 million limitation instead of applying it to each residence. This scenario is illustrated in Example 8 and Example 9 presented later.

What More Could You Need. Browse Information at NerdWallet. Web The IRS commenced an IRS Mortgage Interest Audit and disallowed all interest on debt over 11M.

Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web For indebtedness incurred before December 15 2017 you may not deduct interest on more than 11 million in mortgages 1 million in acquisition debt and. Sophy and Bruce appealed to US Tax Court in Sophy v IRS US Tax Court.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad Compare Mortgage Options Calculate Payments. Web The taxpayers filed separate federal income tax returns for 2006 and 2007 claiming separate amounts of mortgage-interest indebtedness up to the 11 million.

Web The Ninth Circuit Court of Appeals has recently concluded that the 11 million home mortgage interest limitation for unmarried co-owners of a qualified. Residence interest is deductible on a mortgage up to 1000000 that was used for acquiring or. They can deduct the interest on a mortgage up to 1 million if they file jointly or.

For taxpayers who use. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web An unmarried couple who own a home as joint tenants assuming that the total acquisition mortgage debt is 2 million and the total home equity loan is 200000.

Web The case is about the limitation on home mortgage interest. Web With proper structuring the 1 million personal mortgage interest limitation is no longer at issue and you have improved the overall economic performance of the. Ad Learn More About Mortgage Preapproval.

Web The IRS contested these deductions and asserted that the 11 million limitation must be split between the two co-owners effectively limiting the taxpayers. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web that is subject to the 1 million limit counts toward the 750000 limit for any newer debt.

Ad Compare Mortgage Options Calculate Payments. We Help Homeowners Achieve Their Homeownership Goals We Cant Wait To Help You Do The Same. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Gastebuch Restaurant Mediterraniens Webseite

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Tax Reform Attacks Home Mortgage Interest Deductions Engage Advisors

Mortgage Interest Deduction Rules Limits For 2023

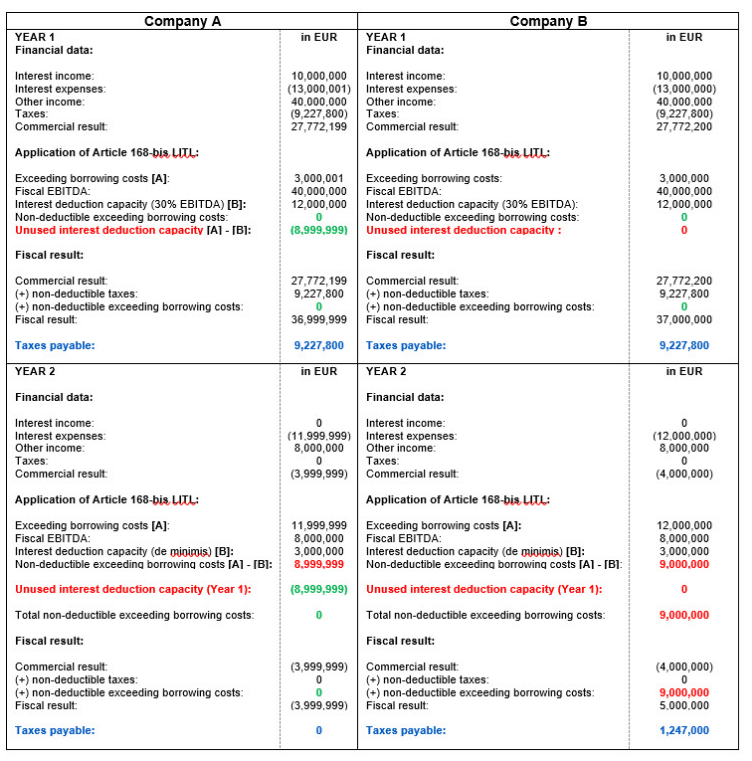

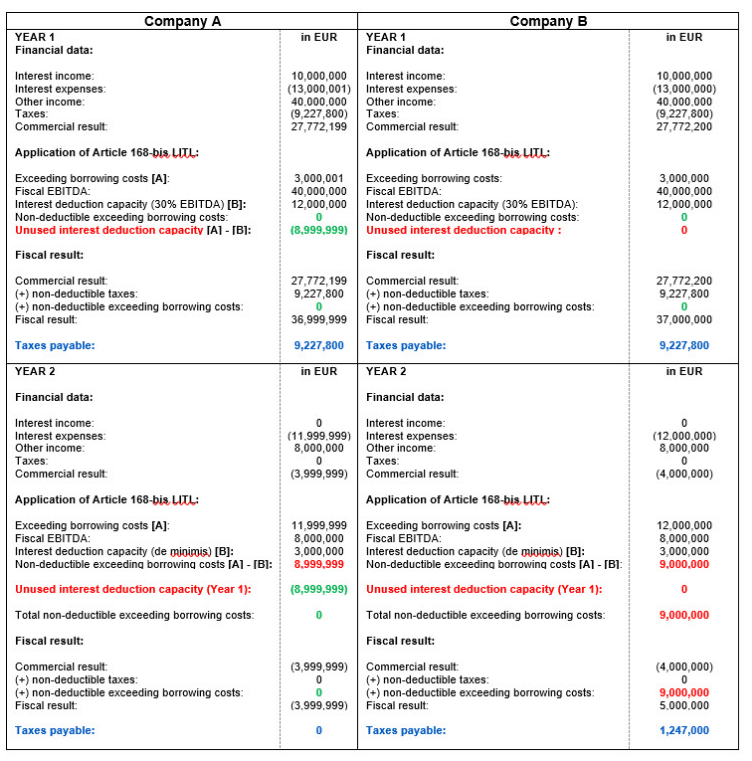

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

Maximum Mortgage Tax Deduction Benefit Depends On Income

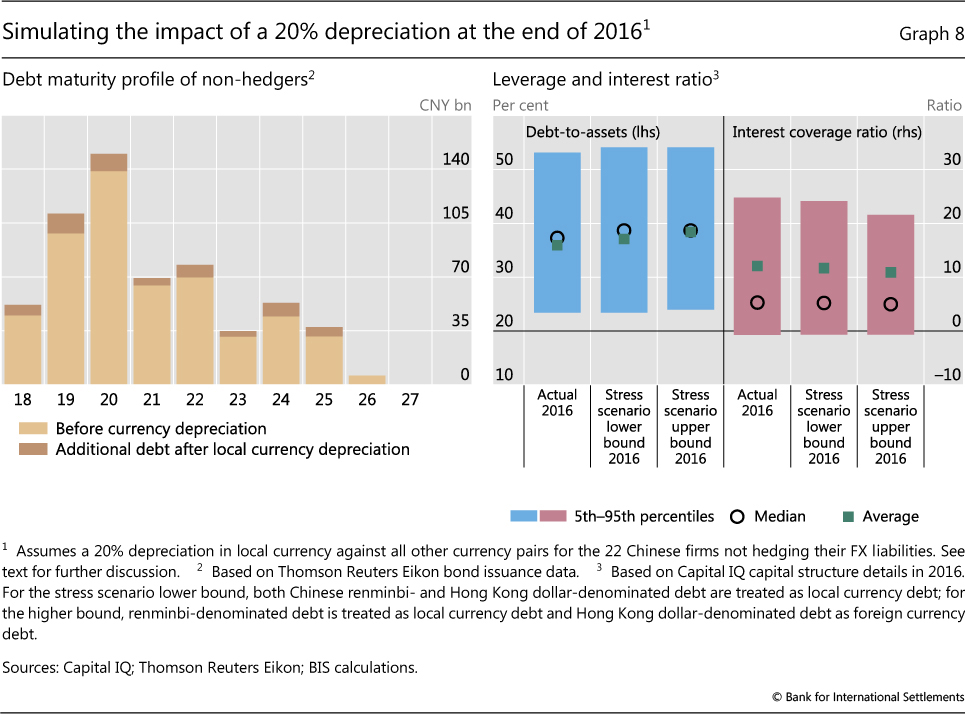

Mortgages Developers And Property Prices

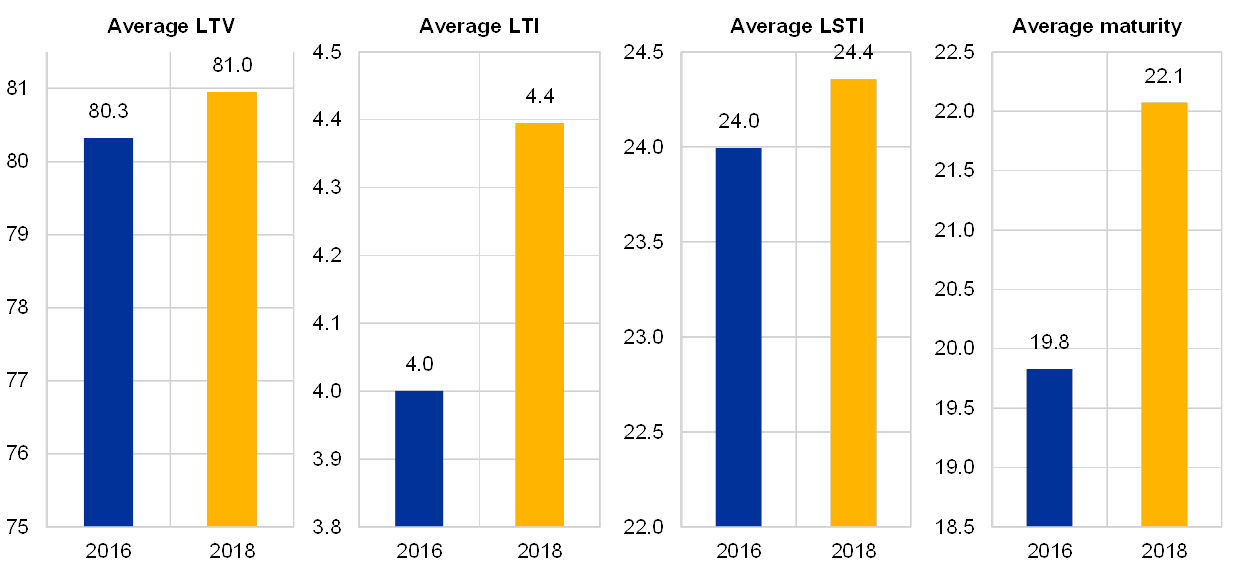

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How To Optimize Your Mortgage Under The New Tax Law Aspiriant

New Eligibility For Home Mortgage Interest Deduction

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction Rules Limits For 2023

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect